How to Active UAN in PF and How to Online Claim in PF

Active UAN in PF and Online Claim in PF from your Mobile Phone

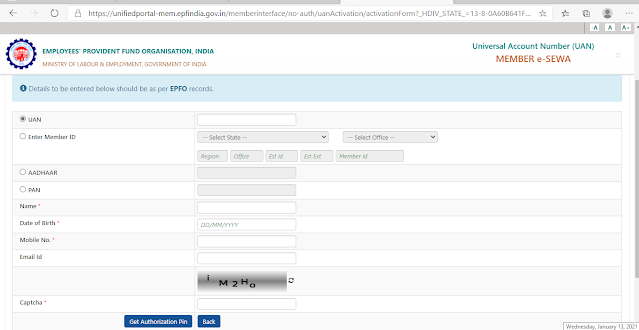

✤ How to Active UAN in PF

● Visit EPFO official website https://www.epfindia.gov.in/site_en/ For Employees' Provident Fund Organisation (epfindia.gov.in).

● Open website Page

✤ Online Claim Process in PF.

● Go to the https://unifiedportal-mem.epfindia.gov.in/memberinterface/ and login using your Active UAN and password and fill the Correct captcha code.

● Open Next Page EPFO Employee account.

● Read Member Profile Details is correct.

➥ UAN Number,

➥ Employee Name,

➥ Birth Date,

➥ Gender,

➥ Aadhar Number,

➥ Pan Number,

➥ Bank Account No.

➥ Mobile Number,

➥ E-Mail Id for Online claim in PF.

● you will Select options under "Online Services" for Online Claim in PF.

⇒ Choose "Claim (Form-31,19,10C&10D)" Option.

● New Member Details tab Open for Online Claim in PF.

Note : Must have been 2 months from the date of submission of the job before filling the form and the date of resignation is required for Online Claim in PF.

When a new job is started, it is mandatory for the company to be an employee. The UAN number is given by the employee from the EPFO who has to Active UAN in PF.

When the job is placed, it should be 2 months from the time of hiring to online Claim in PF. after 2 months employee fill Claim Form for Online Claim in PF

✤ What is Annexure K?

Annexure K is a document which mentions the member details, his PF accumulations with interest, service history, Date of Joining and Date of Exit and employment details including past and present MID. This document is required by the Field Office/Trust to effect a transfer in.

The member e-service portal allows the member to track the status of the transfer

Go to the 'Services Online Services' tab and then submit a claim to 'Track Claim Status'. Once he status in which the claim is filed is "pending with the employer". If the employer

Allows transfer request, changes form status - "Accepted by employer. ending to field office fees ".

T he provident fund monies are to provide for a source of income (social security) after retirement during old age. To create a sizable savings it is necessary to start saving early and accumulate the corpus by reducing intermittent withdrawals. Hence it is advisable to transfer PF with each job change to reap full benefits of the social security schemes.

1. PF transfer lets the past service transferred into the current member ID. If the total service is more than 5 years then TDS is not charged on PF withdrawal. Clubbing of past service may help the member in crossing the 5 year mark thus saving on TDS.

2. Transferring PF amount instead of withdrawing gives the member the benefit of compounding of funds. The compounding effect can be visualized in a way that if a member does not withdraw his PF money on change of job and gets it transferred to his new account then the same money would get doubled in approximately 8 years, assuming EPFO continues to give at least 8.5% interest rate just like it has given in the past so many years.

3. After Active UAN in PF a service of more than 10 years makes the member eligible for pensionary benefits. Transfer of PF accounts ensures that the past services does not get lapsed and continues to get added in the subsequent employment.

.jpg)